Massachusetts Senator Proposes 155% Sports Betting Tax Increase

by Robert Linnehan in Sports Betting News

Updated May 23, 2024 · 7:59 AM PDT

Apr 21, 2024; Boston, Massachusetts, USA; Boston Celtics forward Jayson Tatum (0) drives to the basket past Miami Heat forward Caleb Martin (16) during the second half in game one of the first round for the 2024 NBA playoffs at TD Garden. Mandatory Credit: Bob DeChiara-USA TODAY SportsA Massachusetts Senator has proposed a 155% increase to the state’s online sports betting tax rateSen. John F. Keenan (D – Norfolk/Plymouth) has proposed an increase to the state’s online sports betting tax rate to 51%Keenan’s tax rate is an amendment in the Senate’s proposed FY 2025 state budget

Another state is mulling over a potential increase to its sports betting tax rate.

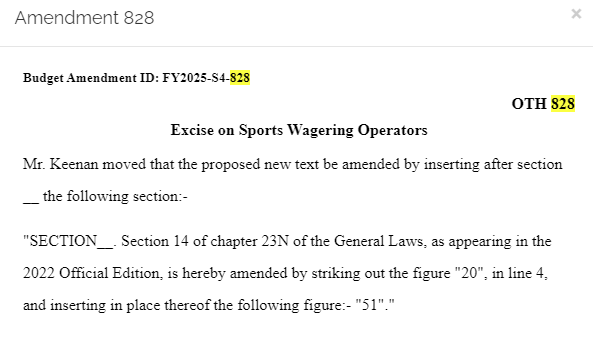

Sen. John F. Keenan (D – Norfolk/Plymouth) proposed an amendment to the Senate’s FY 2025 Massachusetts budget that will increase the state’s online sports betting tax rate from 20% to 51%, a 155% increase.

The Senate is currently debating the FY 2025 budget after being sent the House’s nearly $58 billion state budget last month.

Latest State to Propose Sports Betting Tax Increase

Massachusetts is now the third state actively considering an increase to its sports betting tax rate. Illinois legislators are considering a proposal from Gov. J.B. Pritzker (D) to raise the state’s sports betting tax rate from 15% to 35% and a New Jersey Senator recently introduced a bill to raise the Garden State’s rate from 13% to 30%.

Keenan’s amendment, if approved, would skyrocket Massachusetts into a first place tie with New York in as the highest taxed sports betting state in the country.

Last year, Keenan also introduced an amendment for the FY 2024 budget to earmark $500,000 for “compulsive gamblers’ treatment supports and an independent research study to determine the extent and scope of harms caused by gambling products regulated by the commonwealth.”

If approved and included in the budget, the new tax rate would likely prove to be another high hurdle for operators to overcome for entry into Massachusetts. This comes a day after a public meeting was held by the Massachusetts Gaming Commission on the practice of sports betting operators limiting customers.

In April, the state reported approximately $49.3 million in taxable online sports wagering revenue, which resulted in $9.9 million in tax revenue for the month. If taxed at a 51% rate, this would have led to more than $25.1 million in tax revenue for the month.

Professional gambler and founder of Unabated Sports, Jack Andrews, criticized the state at the roundtable for making it difficult for smaller sports betting operators to do business in the commonwealth.

“Your barriers to entry are very high. Your tax rates and your licensing fees are very high,” he said at the meeting.

An increase to 51% of taxable revenue would likely not make things easier for operators in the state. Add in a $1 million licensing fee, an extensive licensing process from the MGC, 21+ language on all public advertisements, and other hurdles and that makes entry an arduous hill to climb.

New Jersey, Illinois Mulling Tax Increases

As mentioned, New Jersey and Illinois are both considering tax increases for their sports betting operators.

New Jersey Sen. John F. McKeon (D-27) introduced S3064 last month, which aims to increase both the state’s sports betting and iGaming tax rates to 30% of gross gaming revenue. The state’s sports betting tax rate is currently at 13% and its iGaming rate is 15%.

Illinois Governor Pritzker’s budget proposal includes a sports betting tax increase to 35% from 15%, which estimates an additional $200 million in annual sports betting tax revenue. If approved, the new rate would go into effect on July 1, 2024.